The classic 25x Rule and the 4% Safe Withdrawal Rate (SWR) are key principles in the Financial Independence, Retire Early (FIRE) community. These concepts have helped individuals determine how much they need to save in order to achieve financial independence for decades now. In this article, I am going to cover two important questions. Are these Classic Fire Metrics still valid today? If not, what are the new targets we should be aiming for to have the confidence in a financially secure and long retirement?

But first, let’s remind ourselves about what these two financial pillars are, where they came from and how FIRE members have used them to retire early for decades.

The Trinity Study, where it all began

The Trinity Study, conducted by professors at Trinity University in 1998, is the foundation of the well-known 4% rule for retirement withdrawals. This rule suggests that retirees can withdraw 4% of their initial retirement portfolio annually, adjusted for inflation, and have a high probability that their savings will last for at least 30 years. Yes, yes, I can already hear you saying. “But Andy, I went hard and invested my brains out and retired at 40..so I have more like 40 or 50 years of retirement, do these numbers still stack up for me?” Relax faithful reader, I got you covered. Read on.

The 4% Safe Withdrawal Rate

As mentioned above the 4% SWR proposes that you can withdraw 4% of your investment portfolio annually, adjusted for inflation, without running out of money for at least 30 years.

For instance, if you have a $1,000,000 portfolio, you can withdraw $40,000 in the first year of retirement. In subsequent years, you adjust this amount for inflation to maintain your purchasing power. So now just bear in mind that some years your portfolio will grow much higher than 4% and others it might not grow at all. So you need to be strategic about how much you’re making each year and how you do it.

We will discuss the risks associated with how you withdraw funds and when in later article.

The 25x Rule

The 25x Rule follows on from the research of the Trinity Study and the 4% rule. It was made popular by legends in the FIRE community like Mr Money Moustache because of its ease of use and allowing people to understand how much they needed to invest before they could pull the pin of their soul crushing 9 to 5 and kick back. The rule suggests you need to save 25 times your annual expenses to achieve financial independence. For example, if your annual expenses are $50,000, you would need to save $1,250,000 ($50,000 x 25) to retire. This rule is based on the assumption that you can safely withdraw 4% of your portfolio each year. Hence these two rules are used in tandem.

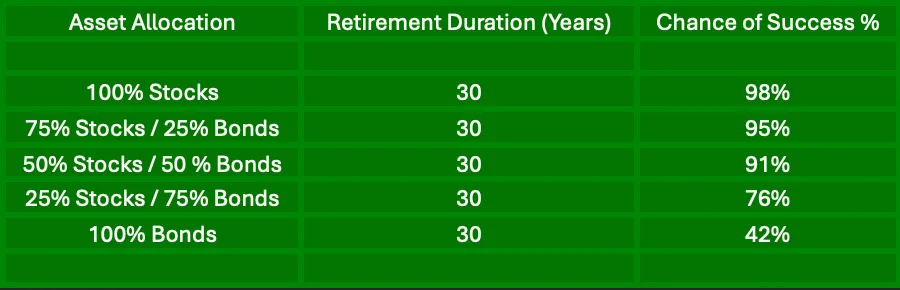

Asset Allocation and Results

Asset Allocation = How much Stocks vs Bonds you own in the portfolio

Chance of Success = The chance that you don’t run out of money before you kick the bucket expressed as a percentage

Recent financial events have highlighted some issues with Trinity.

Some blaring issues that pop out of the Trinity Study that impact on its effectiveness in todays era are;

- The 4% SWR was based on a 30 year retirement period

- The Study relied on historical data between 1926-1995

- It assumed a stable or low inflationary environment

- Humans are just living longer as a species 🙂

A Modern Look at the Trinity Study

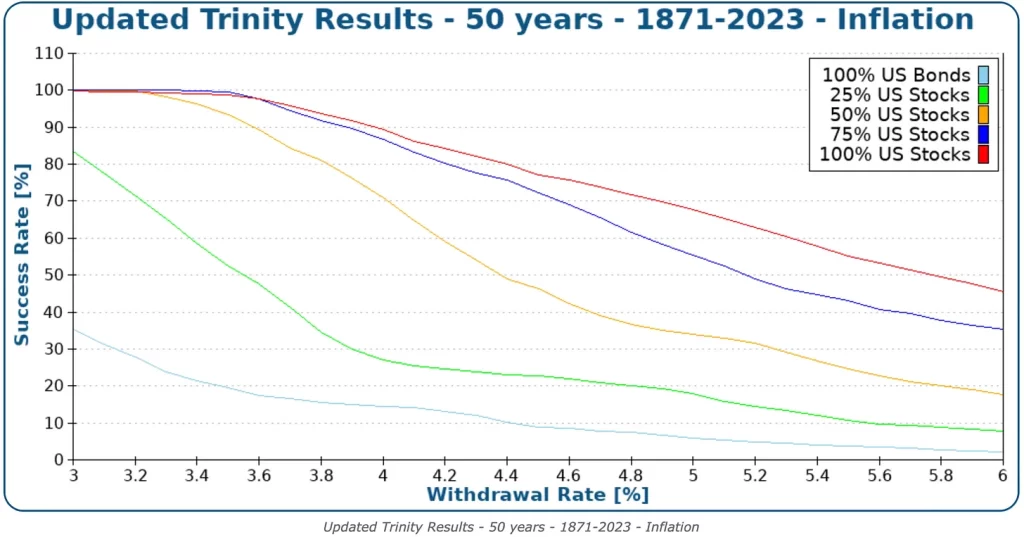

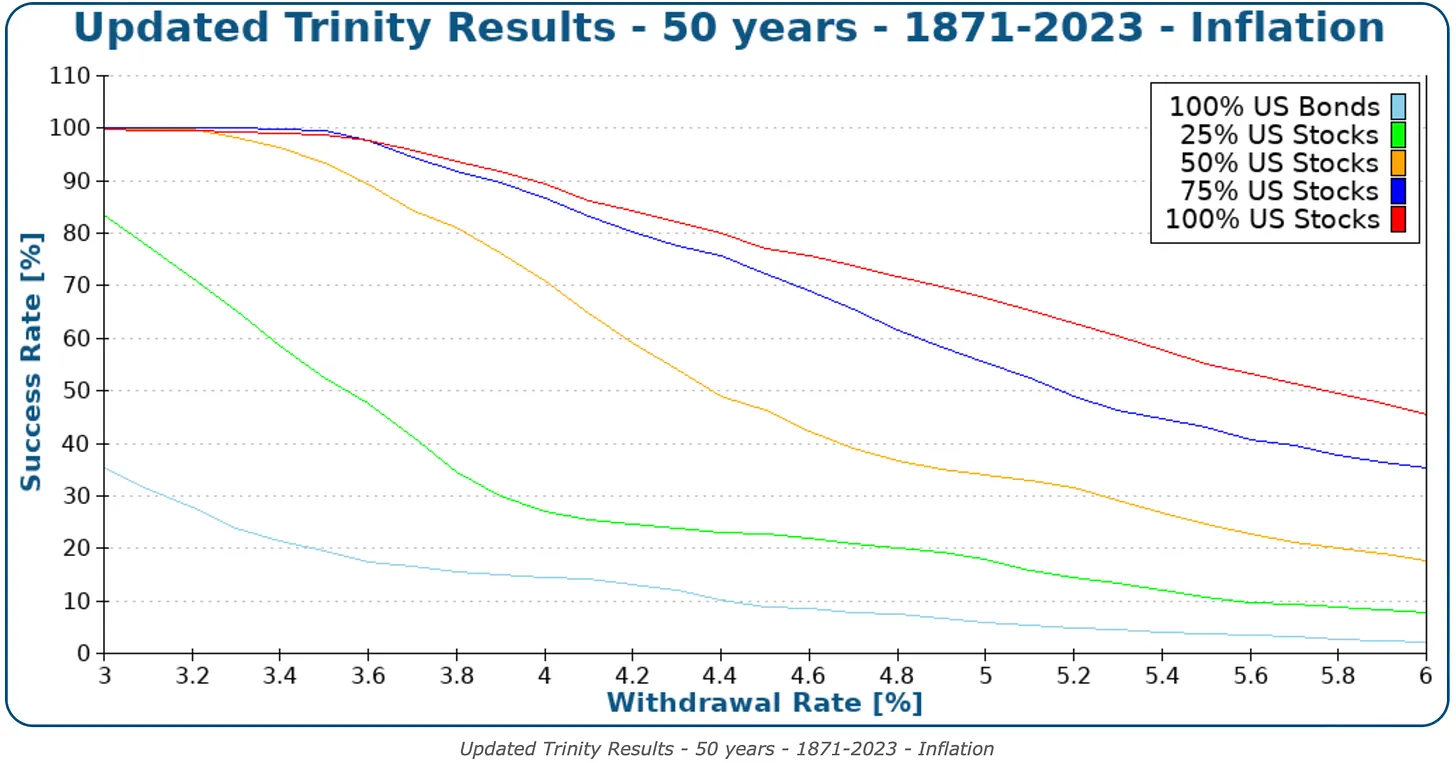

A revised look at the Trinity Study by The Poor Swiss suggested some new options for a SWR that could extend over a longer retirement horizon. Instead of the 30 year maximum retirement length put forward in the original Trinity Study, The Poor Swiss utilised financial historical data going back to the 1870s and expanded the retirement period to 50 years.

The graph above provides an overview of the performance of the various asset allocations over time. The Poor Swiss.

New Safe Withdrawal Rate is…

Ok Andy, so you have waffled on about the Trinity thing and the 25z rule and all this….just give me a safe withdrawal rate I can use so my money last me until I kick the bucket. The 4% rule of thumb can act as a guide but you need to take a closer look at your asset allocation and your likely life expectancy. Looking at the new data and in light of recent financial events around the world it seems more reasonable to have a more conservative approach in order to maximise your chances of making it to your last days with cash in the bank.

A new SWR of between 3.2% and 3.5% depending on your particular asset allocation looks to be the most likely to be successful across the widest range of financial scenarios. Now, this can be subject to other risks like all things but for the most part if you aim to withdraw around this amount you should be well sorted financially when you decide to drop off this mortal coil. Basically If you want to be more cautious then lower that SWR down towards 3 and if you want to live a little on the wild side you can jack that number up closer to 3.5.

Finding Your New Freedom Number – The Calculation

- Decide how conservative / Risk tolerant you want to be in retirement

- Lets say you want to aim for a conservative 3.2% SWR

- Find your new X Multiple;1 / 3.2 (SWR) = 31.25 – This is your new X Multiple

- Now work out your annual expensesLet us go with annual expenses of $50,000

- Now apply your Annual Expenses x Your X Multiple to give you your new freedom number;50,000 × 31.25 = $1,562,500

So, you would need to save $1,562,500 if your annual expenses are $50,000 and you are using a 3.2% SWR. Now you have your new investment target for a 50 year retirement horizon that should enable you to sleep soundly at night.

Conclusion

The Trinity Study was a transformative research paper that enabled people in the FIRE Community to understand and plan for their retirement. It provided some simple metrics like the 4 SWB and the 25X rule to empower people to strive for early retirement. Since it was published in 1998 there has been a number of financial events such as the Sub-Prime Mortgage Crises, Covid and the current cost of living crises. These events have changed the financial landscape and given investors reasons to be more cautious about their retirement savings and the manner in which they go about it. The caution has meant we need to move beyond the 4% SWR and the 25X rule.

Mr Money Moustache and The Poor Swiss have shown us that we need to revise those old metrics to allow for the more dynamic environment that we find ourselves in. A safer SWR of 3.5% and the less catchy 28.5X rule is now the order of the day. So with that in mind, go forth and make that money multiply.

Until next time 🙂

Andy

Lisbon

July 2024